With the upcoming Autumn Budget just weeks away, we’re looking at how the buy to let market is currently performing to give you a better picture of the current state of the PRS.

The current backdrop to the buy to let market is somewhat challenging. Whilst we eagerly await the confirmation of Rachel Reeves’ tax plans in the Budget this month, we’re also facing the reality of ongoing geopolitical conflicts and the inevitable rise in winter household bills.

Amidst these challenges, the buy to let market continues to perform strongly. Below, we discuss the latest data in Hometrack’s September 2024 UK Rental Market Report, including:

- Whether rents are still rising

- The ongoing supply and demand imbalance

- Where to invest

- The outlook for rents in 2025

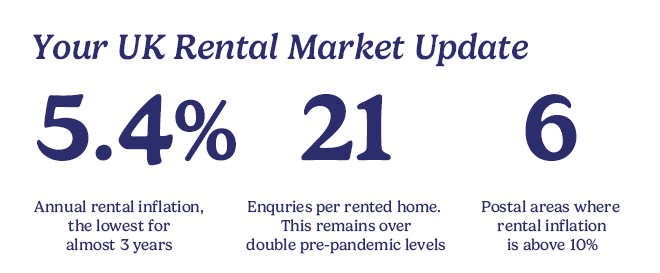

UK Rental Inflation

Annual rental inflation in the UK has slowed to its lowest since September 2021, down to 5.4%. This is almost half what it was just one year ago, at 10.2%.

Compared to other money market figures, rents are experiencing a much more drawn-out slowdown, primarily due to supply and demand. With rental demand still far outpacing the return of new properties to the rental market, upward pressure on rents continues.

Rental demand

Demand for rental homes continues to cause competition amongst prospective tenants. With 21 enquiries per rented property, demand is double that of pre-pandemic levels.

Hometrack expects this trend to continue into 2025 and potentially grow even further as deposits remain unaffordable for most renters. With no real growth in the affordable housing sector, tenants will continue to rely on the PRS for safe and secure homes.

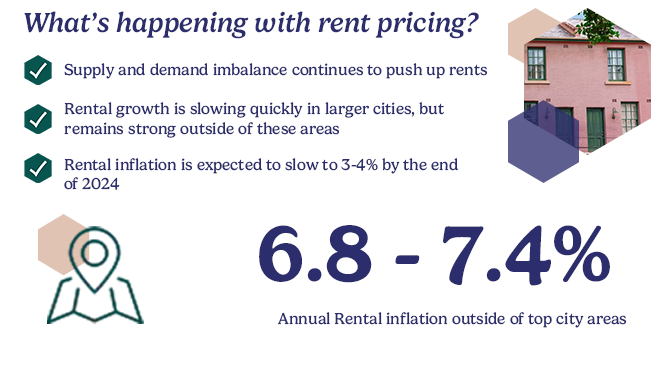

Cities vs Towns

The difference between rental pricing in major cities and surrounding areas also increases rental inflation.

Over the last three years, the UK’s largest cities have consistently recorded the highest gains in average rents, at over 10% per year. Not only is this unsustainable for tenants, but the unaffordability in these areas stunts rental growth.

We are now seeing rental growth slowing in these core cities, with rents up by 5.8% year-on-year, compared to a 10.7% growth a year ago. London, for example, has seen the most significant slowdown, with rents rising at just 2.5%, down from over 12% last year. These cities account for a staggering 30% of all private rented stock and are fundamental to the rental market.

As a result, we’ve seen rental inflation in non-city areas increase. At an above-average rate of 6.8-7.4% a year, these areas are now experiencing heightened demand as tenants avoid the higher city pricing. For landlords looking for their next investment, it may be worth looking further afield to the typical hotspot areas to benefit from this increase in demand.

Potential tax changes – a threat to the rental market?

The lack of rental supply has been a prevalent issue for the last three years. With mortgage rates softening, some renters have been able to exit the PRS, increasing the number of new homes to rent, up 18% year-on-year. However, despite this increase, the metric is still down 25% from its pre-pandemic average.

It's also fair to say that some landlords have sold investment property. Despite the media coining this as the ‘mass-exodus’ of landlords, the reality is many have hit retirement age or have chosen to recentre their portfolios around their highest-yielding assets. As of July, the number of previously rented homes up for sale increased to 12.5%.

Now, as we face the Budget (and the expected tax changes), there are some concerns that we will see more landlords leave the sector. For landlords looking to weather the storm, this is largely positive. A drop in supply means rental growth will continue to grow, promising better rental yields and a strong property portfolio. Only growing affordability difficulties amongst tenants will slow these rent rises.

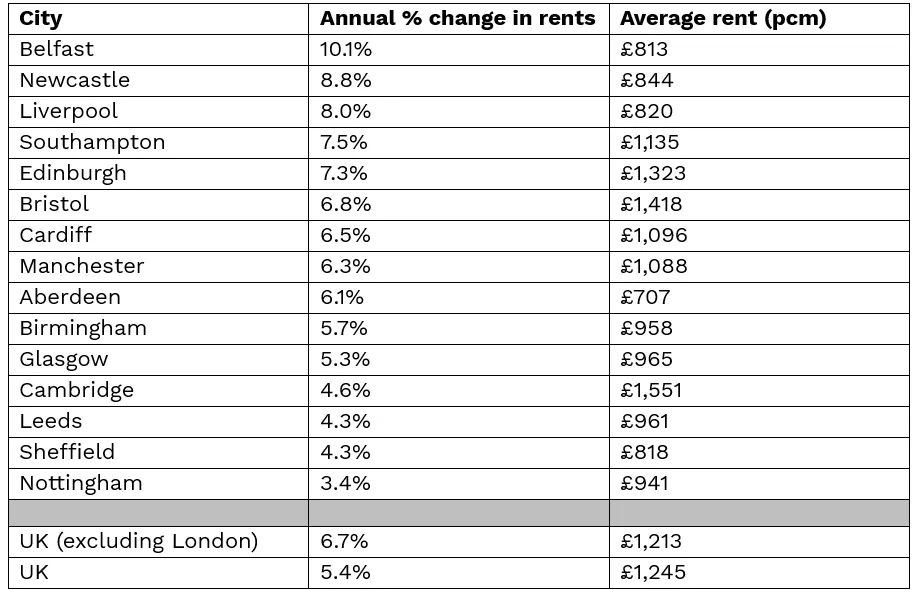

Where to invest in property

Regionally, the Northeast has performed best in annual percentage change in rents, at 9.1%. Scotland and the Northwest follow just behind at 7.8% and 7.4% respectively. Conversely, as mentioned above, London has seen the worst growth, at just 2.5%. Despite showing much more positive signs of annual growth, the East Midlands and Yorkshire and the Humber also find themselves in the bottom spot, with growth of 5.6% for both regions.

The table below shows a clear breakdown of how cities across the UK have performed: