How can you find the right type of property to invest in? And which will work best in your portfolio? Here, we look at the best types of property investment for experienced landlords and new investors.

Whether you’re looking to diversify your property portfolio or taking your first steps on the property investment ladder, knowing which type of property to invest in is essential. Furthermore, a diverse portfolio is a fantastic way to maximise rental profits. Your experience level and budget will impact which types of properties are right for you. Below, we discuss:

- The different types of properties to consider

- The best types of property to consider based on rental yields, capital gains, and location

- How to invest in investment property

What are the different types of BTL property?

Buy to let property covers a lot of bases. There are plenty of different branches to buy to let, from more ‘vanilla’ property to complex investment types. Typically, the more complex a property is, the higher the rental yields you’re likely to achieve. This is not an exhaustive list of the types of properties that you should consider, but it may offer some inspiration when planning your next property investment.

Houses in Multiple Occupation (HMOs)

Houses in Multiple Occupation (HMOs) are a great starting point for experienced landlords looking to diversify their portfolio. The shared amenities and multiple tenants on one AST make this a complex property type, so you may need to approach more specialist lenders. However, with many more lenders entering the HMO market, mortgage rates are much more competitive.

Student Accommodation

Student properties often fall under the same branch as HMOs. The high demand from the rising number of university students makes these properties a fantastic long-term investment. You must let your broker and lender know that you plan to let to students to ensure your mortgage product accepts this tenant type.

Multi-Unit Freehold Blocks (MUFBs)

Multi-Unit Freehold Blocks (MUFBs) consist of multiple units or flats on one single freehold. Typically, these properties have separate entrances for each resident, with each unit on its own AST agreement. All MUFBS have private areas for each resident, with some having communal spaces such as an entryway or garden. Mortgage rates for these properties will likely be 1-1.5% higher than standard buy to let rates, but the higher rental yields on offer more than compensate for this.

Holiday Lets

You may also consider a holiday let property. Holiday let mortgages are specifically for properties let out for short periods of time, from a few nights to a couple of weeks, whereas a buy to let is a tenant’s home, let out for six to twelve months at a time. A number of buy to let lenders offer holiday let mortgage products, but in some cases, it’s worth approaching a commercial mortgage lender for a more generous loan amount, so it’s essential to discuss your plans with a broker.

Semi-Commercial Property

Finally, semi-commercial properties are a fantastic opportunity for the more experienced landlord looking to diversify into the commercial sector. A great asset to your portfolio, these properties require finance from a commercial mortgage lender and benefit from a 3% stamp duty surcharge exemption.

What is the best type of property to invest in?

As mentioned, the best type of property for you to invest in will depend on several factors and your individual circumstances. Generally, landlords look at how properties are performing in terms of their rental yields.

Rental yields

Properties that generate higher rental yields are naturally more popular among landlords. Factoring in the projected rental yields from a property is essential to making well-informed property investment decisions.

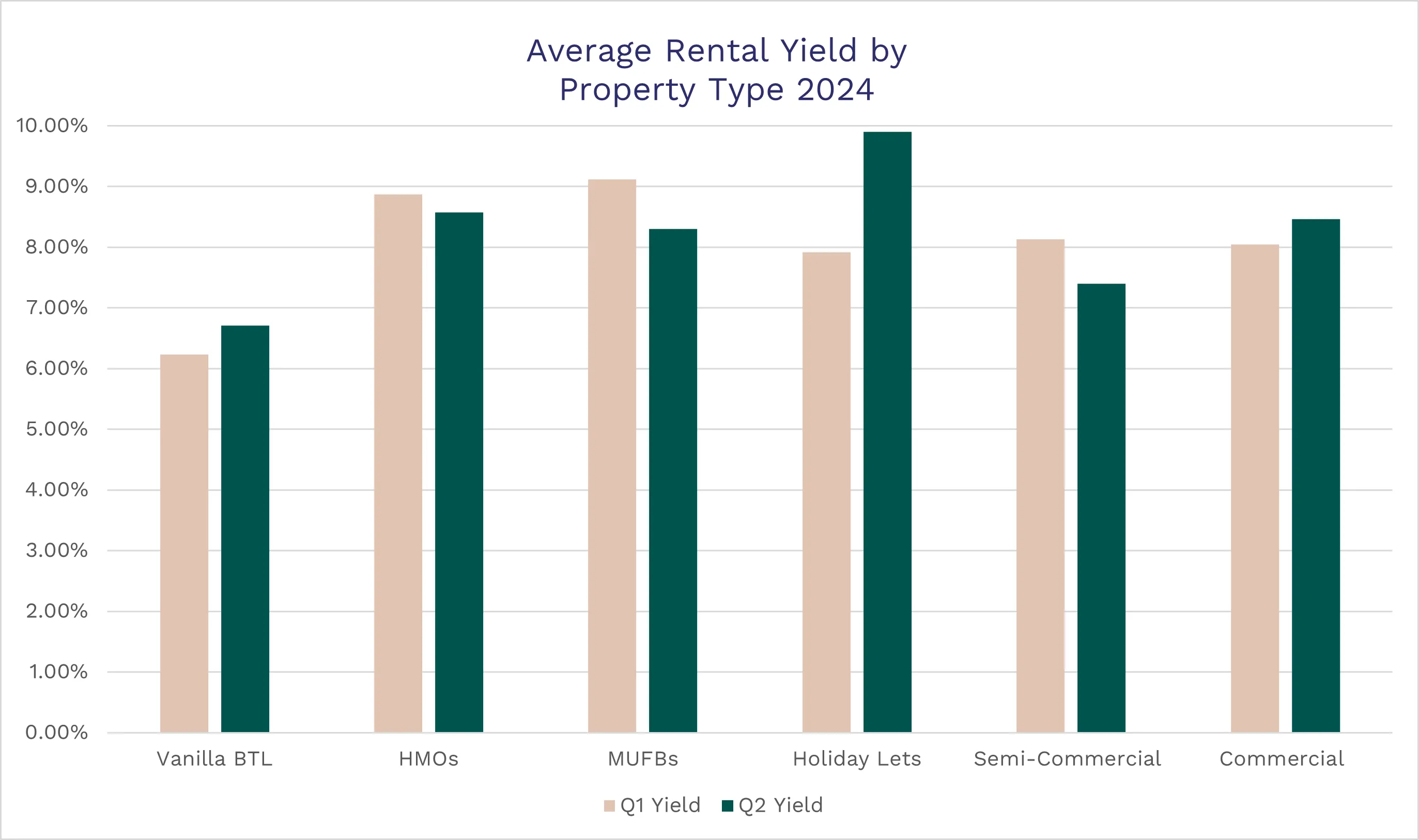

Our own data for Q2 2024 shows just how well each property type mentioned above has been performing. As a reference point, vanilla buy to lets generated average yields of 6.23% and 6.71% in Q1 and Q2, respectively, this year.

The data reflects the challenges the property market has faced since January. Only vanilla properties, holiday lets, and commercial properties have seen an increase in rental yields on a quarterly basis. HMOs, MUFBs, and Semi-Commercial properties, typically the properties we expect to perform best, all saw a slight drop.

Holiday lets had the most impressive increase in average rental yields, jumping from 7.92% in Q1 to 9.90% in Q2. HMOs, although down on last quarter, showed the second highest average yield for Q2, at 8.57%, a slight drop from 8.87% in Q1.

Why have we seen some rental yields drop?

Over Q2, house prices have been on a gradual incline, which may explain why some property types have seen a slight drop in rental yields. Zoopla’s latest house price index predicts a 1.5% rise in UK house prices by the end of the year.

Similarly, SWAP rates have experienced a level of volatility over the last three months due to the general election, EU election results, and ongoing geopolitical conflicts. Furthermore, mortgage rate pricing, although still softening, has seen some increases across the more specialist product ranges.

How to invest in buy to let property

Whatever type of property you’re looking to invest in, working with an experienced broker is essential. We can support you every step of the way with unparalleled advice on your initial enquiry to a successful completion. We handle the hard work for you, by finding you the best mortgage rate for your individual circumstances and having a thorough review of your application before you submit to save you time and money.

Speak to an expert

Our team of experts are all specialists in their areas, meaning we can discuss your goals to help you make the right property investment decisions.

To see what types of mortgage rates you could access and speak to a broker, call us on 0345 345 6788 or get in touch here.