Earlier this year, we looked at your peers’ biggest concerns for 2024. Has the year justified these fears, or is there a brighter outlook for the market?

With a new Labour government, the mortgage market landscape has changed drastically since the start of the year.

In February, we highlighted the Top 5 Landlord Concerns for 2024 and how to navigate these changes. To what extent have these concerns impacted landlords? Are there signs of a more positive buy to let sector on the horizon?

Landlords’ Top 5 Concerns

1. Rising interest rates and mortgage payments

At the start of 2024, 47% of landlords ranked rising mortgage payments and interest rates among their top concerns for the year, the most significant issue facing landlords.

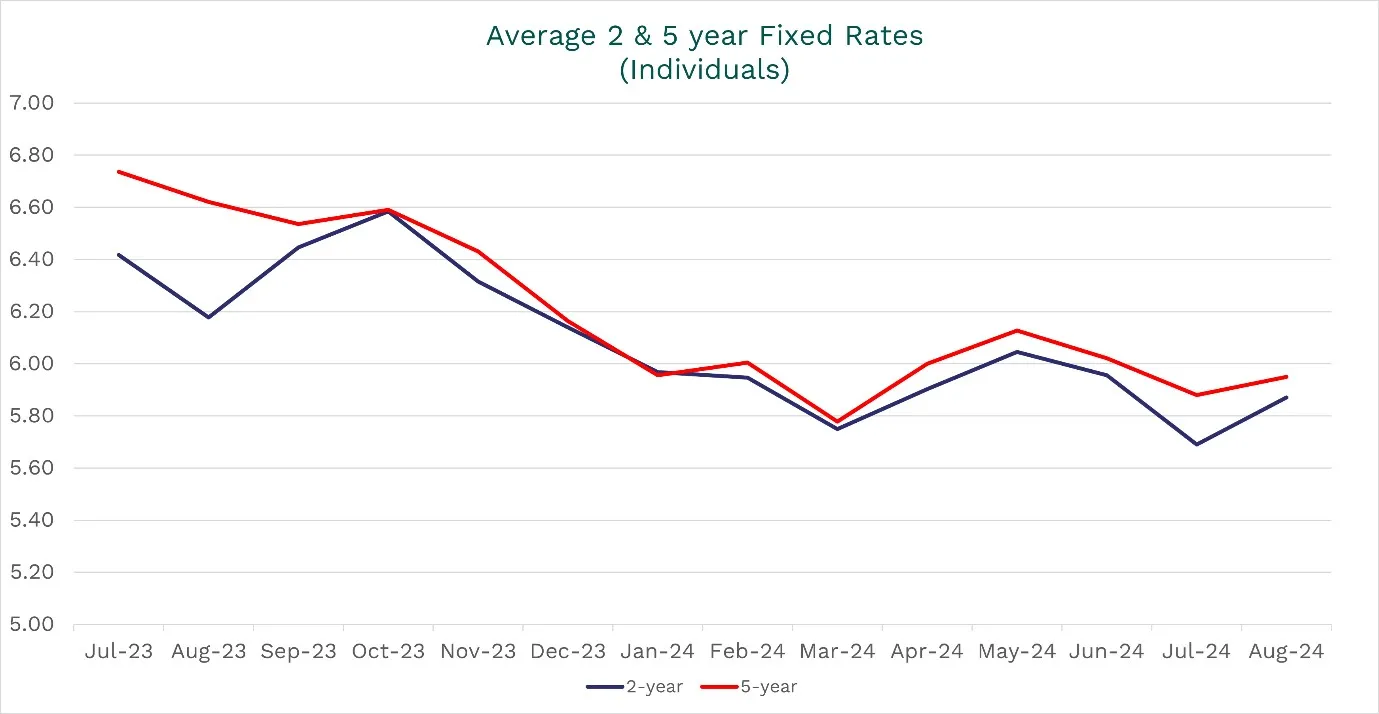

Positively, average mortgage rates for individuals and Limited Companies have softened since the start of the year and are notably down from the same period in 2023. So far in August, average rates are 5.87% for 2-year fixed products and 5.95% for 5-year fixed rates. In January, rates were 5.97% and 5.96%, respectively, showing a slight softening in pricing over the last eight months. However, looking back at August 2023, we see a much more notable drop in rates, at 6.18% and 6.62% this time last year.

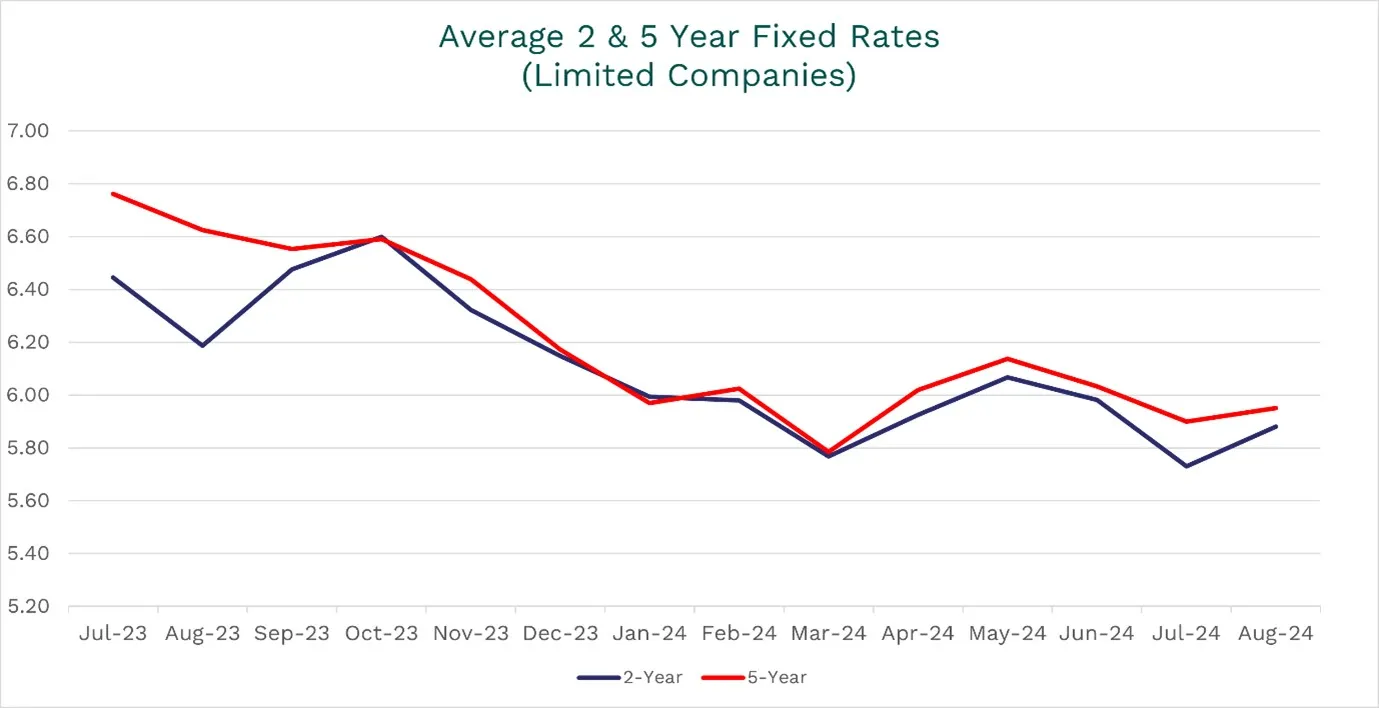

The Limited Company data reflects the same trends. Currently, average rates are 5.88% for a 2-year fixed rate and 5.95% for a 5-year deal. This is a slight drop from 5.99% and 5.97% in January this year and a substantial decrease from 6.19% and 6.62%, respectively, in August 2023

.

.

What can you expect from mortgage rates in the future?

May’s surprise general election announcement sparked new uncertainty in the money markets. Consequently, we saw SWAP rates rise and ultimately delay further decreases in mortgage rate pricing.

Despite this, rates are back on their downward trajectory, and the first Base Rate reduction in four years only further confirms the path of stability the market is now on. With lenders looking to price competitively and increase their business volumes, it’s worth speaking to our expert brokers to explore the types of rates you can access to boost your property portfolios.

2. Tenants unable to afford rental payments

Following just behind rising rates was tenants' inability to afford their rents, a concern for 44% of those surveyed. Research from Molo revealed that 59% of UK landlords noted an increase in late rent payments since 2021 due to the cost-of-living crisis.

Whilst there is no data for 2024 just yet, rising rents are undoubtedly still significantly impacting private renters. The rate of rental growth in the year to April 2024 was the slowest in 2.5 years, at 6.6%, but the average rent for a new let in the UK remains as high as £1,226, according to Zoopla.

Protecting your property investments

With mortgage rates softening rather than coming down significantly, it’s unlikely that rents will become more affordable to tenants any time soon. If your tenants are struggling, it’s vital to maintain clear lines of communication, and you may be able to come to a temporary agreement to ease both parties’ financial stresses. Joining a landlord association allows you to easily access support and legal advice for these situations. iHowz Landlord Association is a great place to start.

3. Changes to tax laws

36% of landlords were highly concerned about further changes to tax laws, from buy to let income tax rates and capital gains tax (CGT) allowances. Positively, we’ve not seen any drastic changes to taxes on the PRS this year. The new Labour government have confirmed that no taxes on working people will rise in their highly-anticipated Autumn statement but has failed to rule out changes to CGT. As such, it’s a waiting game to see whether Rachel Reeves will look to support landlords better than her predecessors.

Navigating legislation and tax changes

It’s more important than ever to keep up to date with any changes to tax laws or landlord legislation. Sign up for our free weekly newsletter to read the latest changes as they happen.

If you have any concerns about how tax changes could impact your property investments, speak to a qualified tax advisor, ideally with a good understanding of the buy to let market.

4. Rising maintenance and redecorating costs

34% of landlords cited rising costs, specifically maintenance and redecorating costs, as a key concern for 2024. As inflation has softened, costs have come down slightly; however, the reintroduction of minimum EPC targets has meant that landlords may need to spend large sums of money to improve their property’s energy-efficiency ratings. We’re still awaiting further clarity from Ed Miliband on how these plans will be implemented and, more importantly, what the government will put in place regarding spending caps and exemptions.

5. Landlord insurance costs increasing

34% of landlords placed rising landlord insurance among their top concerns. Given the general market sentiment, it’s understandable that many of you will be looking to acquire insurance with extra protections, making it challenging to reduce costs.

Finding the right landlord insurance

Like with any other insurance, it’s important to shop around for a good deal. MFB is a proud partner with Alan Boswells, an award-winning insurance provider specialising in landlord insurance. Get a quote for your landlord insurance here.

To see how our experts can help you on your property investment journey, get in touch on 0345 345 6788 or submit an enquiry here.