Looking for affordable property investment opportunities? Here are the hot spots for landlords to focus on in 2025.

With the upcoming Renters’ Rights Bill promising the biggest changes to the rental market we’ve ever seen, many new measures are likely to hit landlord profits. The abolishment of Section 21 evictions will cause many more landlords to face costly court evictions, and the government is expected to pass on the costs of the new Property Ombudsman and Landlord Portal to investors.

Furthermore, the pace of rental growth has slowed as tenants have reached their affordability limit, and the surprise hike on the Stamp Duty surcharge will make new property investment purchases more challenging.

It’s important now to maximise your return on investment and find new, affordable opportunities to boost your portfolio in 2025 and keep Stamp Duty costs down. New data from Hamptons estate agency reveals the best places to invest with a deposit of £25,000 to cover the minimum 25% deposit needed on a buy to let.

Each of the top three locations offers an average gross yield of over 10% from an initial £25,000 deposit, making them a fantastic option to consider.

1. Blaenau Gwent, Wales

Blaenau Gwent, a county borough in Wales, takes the top spot as the highest-yielding area for buy to lets. Low house prices in the area keep stamp duty costs down, and you’ll benefit from lower mortgage repayments, boosting rental profits.

- Average flat price: £72,780

- 25% deposit: £18,200

- Estimated Stamp Duty: £3,639

- Average monthly rent: £672

- Estimate rental yield: 11.1%

Angela Davey of Peter Alan, a Welsh estate agency, commented, “There is […] a massive market of young couples and families who can’t buy, but rent for a few years while they save for a deposit.

“In some cases, they end up buying the house from the landlord.”

She goes on to point out that landlords must be licenced and registered in order to let out properties in Wales, which has seen a rise in standards and fewer regulation changes for property investors in the area.

2. County Durham, Northeast

It’s a similar story for property investors focusing in Country Durham. With low property prices, the area is also highly sought after due to its direct rail links to both London and Edinburgh and its close proximity to Durham University.

- Average flat price: £79,750

- 25% deposit: £19,937

- Estimated Stamp Duty: £3,988

- Average monthly rent: £689

- Estimated rental yield: 10.4%

Just as in Blaenau Gwent, this allows a £25,000 budget to stretch to cover both the initial deposit and the stamp duty charge.

3. Blackpool, Northwest

The regeneration of tourist hotspots around the city of Blackpool has given this area a boost in property investment opportunities.

- Average flat price: £81,380

- 25% deposit: £20,350

- Estimated Stamp Duty: £4,069

- Average monthly rent: £683

- Estimated rental yield: 10.1%

However, the most popular property types amongst landlords in this area are two and three-bedroom terrace houses. Hamptons data shows that the average price for these properties is £117,270, so you would need a budget closer to £50,000 for this investment type.

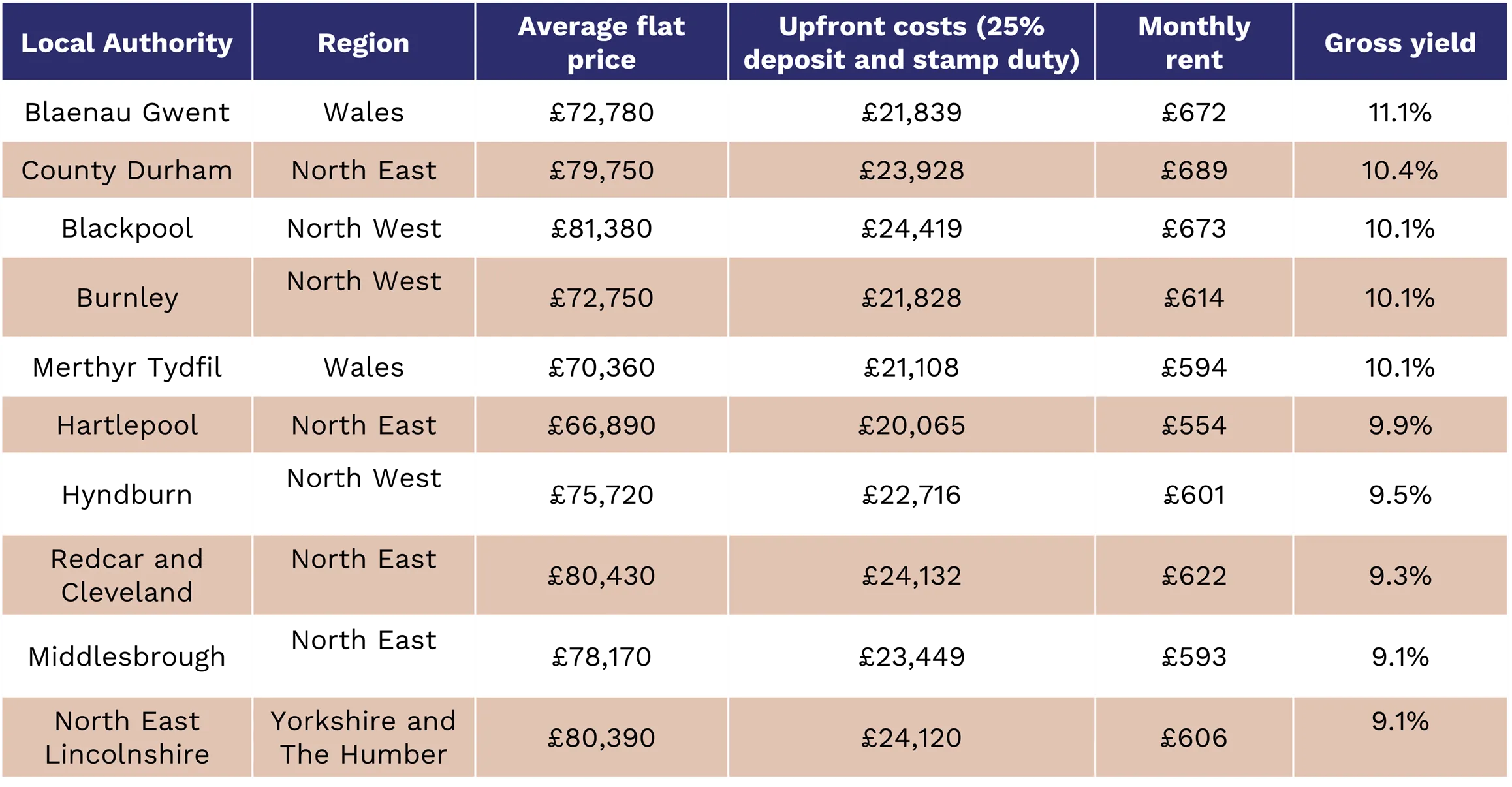

The Top 10 Areas for the Highest Buy to Let Returns

Here are the top 10 areas for the highest but to let returns:

Explore current mortgage rates

If you want to explore what types of mortgage rates you could access for your next property investment endeavour, use our buy to let calculator here.

Alternatively, have one of our experts find the best mortgage rate on the market to suit your needs. Get in touch with our team on 0345 345 6788 or submit an enquiry here.